Selling A Car In Washington State Sales Tax

The use tax is applied at the same rate as sales tax at the purchasers address and is paid by the buyer when the car title is transferred. Renewal and registration fee information.

If I Buy A Car From California And Live In Washington State Do I Have To Pay Taxes Twice Quora

A report of sale can be filed online in person at any vehicle licensing office or by mail.

Selling a car in washington state sales tax. All nonresidents may be exempt from sales tax based on. According to the Sales Tax Handbook a 65 percent sales tax rate is collected by Washington State. The type of item sold eg.

As of July 28 2019 youll pay 1325 to report the sale of your vehicle. Since 1935 Washington residents have had the responsibility under state law to pay use tax on the purchase of a vehicle from a private party. You will pay it to your states DMV when you register the vehicle.

The buyer asks to have 5000 in cash. Regional Transit Authority RTA tax. Alternative Fuel Vehicles and Plug-In Hybrids Washington State Tax Exemptions.

The sales tax exemption is allowed only for the remaining 5000. The seller should file a report of sale within 5 business days of the transaction taking place. This would happen if a vehicle was purchased from a private party or if it was purchased outside of Washington.

For more information please see Washington Administrative Code WAC 458-20-178 WAC 458-20-17802 WAC 458-20. In addition to use tax youll be responsible for. Buying a new car insurance policy.

Subtract what you sold the car for from the adjusted purchase price. Keep a copy of the report of sale for your records. Nonresidents including students who are temporarily residing in Washington must pay retail sales tax when purchasing a vehicle if they intend to use the vehicle in Washington for more than three 3 months.

Sales of motor vehicles to nonresidents. The motor vehicle saleslease tax of three-tenths of one percent 03 on motor vehicles also applies when use tax is due on a vehicle. Even if you purchase your vehicle in the neighboring state of Oregon which has no sales tax Washington sales tax still applies and must be paid when you register your vehicle.

Washington State Vehicle Sales Tax on Car Purchases. A dealer accepts a trade-in with a fair market value of 10000 on a 25000 vehicle. You and the buyer of your vehicle must fill out a Washington State bill of sale.

However you do not pay that tax to the individual selling the car. Paying a Washington Department of Licensing DOL vehicle. Nonresidents stationed in Washington.

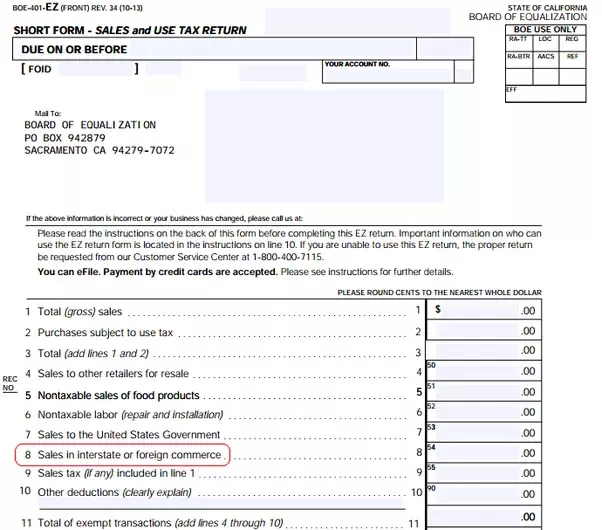

Vehicles and trailers watercraft or farm machinery Where the item was received by the customer delivery and receipt outside Washington are interstate or foreign sales. Fees taxes and donations. The state of Washington charges 1325 to report the sale of a vehicle.

The states VehicleVessel. Yes you must pay sales tax when you buy a used car if you live in a state that has sales tax. Local transportation benefit district fees.

A use tax is charged in the absence of a sales tax. In addition Washington county taxes are applied as well at a rate of 03 percent of the sales priceThe tax money collected is allocated toward various state funded services like road maintenance. On top of that is a.

So if you bought the car for 14000 and sold it for 8000 you would have a capitol. The motor vehicle saleslease tax. Theres no fee to report the sale of a boat.

If you take this approach though the DMV in your home state may need to check the cars vehicle identification number VIN to make sure it matches the out-of-state titling. If you buy your vehicle from a private seller instead of a dealership you can simply pay the sales tax when you register the car in your home state. Sales tax exemption is still allowed for the full 4000 trade-in value and sales tax is computed on the remaining 6000 of the new purchase price.

The state where you register the car is the one that charges the sales tax not the state where you bought the car. But unlike a sales tax which is based on purchase price a use tax is based on a vehicles fair market value. For example when you purchase a used vehicle from an individual there is no sales tax involved so the state instead charges a use tax.

Use tax is paid at the time a vehicle is registered with the Department of Licensing if sales tax was not paid at the time the vehicle was acquired by the current owner. How To Sell A Car in Washington State. Sales tax exemption for nonresidents.

WA residents stationed outside the state. Washington State Vehicle Sales Tax on Car Purchases According to the Sales Tax Handbook a 65 percent sales tax rate is collected by Washington State.

States With Highest And Lowest Sales Tax Rates

Car Tax By State Usa Manual Car Sales Tax Calculator

Sales Tax Exemption Increase On Used Cars Proposed

Car Tax By State Usa Manual Car Sales Tax Calculator

What Is The Pennsylvania Sales Tax On A Vehicle Purchase Etags Vehicle Registration Title Services Driven By Technology

How To Avoid Paying Car Sales Tax The Legal Way Find The Best Car Price

What S The Car Sales Tax In Each State Find The Best Car Price

Nj Car Sales Tax Everything You Need To Know

Understanding The Basics Of Horsepower And Torque In 2021 Trucks For Sale Horsepower Supercharger

Gst On Used Or Second Hand Cars Carsguide

What Is The Washington State Vehicle Sales Tax

Velodyne Which Makes Lidar Used By Uber Comments On Fatal Crash Self Driving Crash Uber

More Evs Will Get A Sales Tax Break Of 3 000 In Washington State Starting In July Electric Cars Bmw Electric Car

Audi Cars R8 Images Wallpapers Audi Sports Car Audi Cars Audi R8

Post a Comment for "Selling A Car In Washington State Sales Tax"